Apple on way to being the world’s first trillion dollar company?

When he started Apple out of his garage, Steve Jobs had a vision. Bring computing products to the masses. Since his passing a few years ago the company has continued to build on the foundation of which he created, continuing to innovate and bring to market exciting new technology. As a result, Apple as a company has grown exponentially and is now one of the largest corporations on the planet. So where does Apple go from here?

When he started Apple out of his garage, Steve Jobs had a vision. Bring computing products to the masses. Since his passing a few years ago the company has continued to build on the foundation of which he created, continuing to innovate and bring to market exciting new technology. As a result, Apple as a company has grown exponentially and is now one of the largest corporations on the planet. So where does Apple go from here?

Apple Music and other innovations

Apple has always been at the forefront of innovation, and 2015 has brought about some interesting new products that the company hopes will push its bottom line even further forward. The company continues to push the music industry onward, having just announced its plans for a new streaming music service to compete with Pandora and Spotify. The much awaited Apple Watch is getting a new software update which is on the precipice of release. On the software front, the company continues to roll out new operating system updates. The latest iOS 9 and OS X El Capitan aren’t too big of a stretch from current systems, but do add much needed improvements to an already robust operating software.

Are new products living up to expectations?

It is one thing to create new products; it is another for those products to become hits with consumers. Apple made a splash with its futuristic Apple Watch, but so far, responses have been mixed. Although the watch hasn’t officially been released in stores, the first reviews from actual consumers aren’t looking too promising. Additionally, the previously mentioned Apple Music service that is set to compete with Pandora isn’t sparking investor’s interest; with some thinking it will have little to no effect on the company’s bottom line and profitability. Not only that, the service may be violating antitrust regulations in various states, and this is all before the service has even been released to the public. The recent climb down in the face of criticism from Taylor Swift, does illustrate how quickly the firm can respond to sentiment – whether from consumers or partners.

Revenue growth slowing and market share under threat

Not so long ago Apple was growing its revenue at a torrid pace. 2013 was the first year that the company failed to reach double digit revenue growth, and the slowdown was thought to be in large part due to sluggish iPad sales and the lack of new and innovative products.

Since Apple creates both software and hardware for all of its product lines, it see’s direct competition from a plethora of companies looking to take it down. Although the feud between Microsoft founder Bill Gates and the late Steve Jobs is over, the battle between their remaining companies still goes on. The battle of PC vs. MAC operating systems has been a war that will continue to rage on, but it seems this is now only a battle for second place, as both companies have been surpassed by Google and its Android OS, which is dominating the operating system market today. The competition in the mobile industry between Apple and Android is fierce. Everyone has their own opinion on which platform is better, and Android has been the popular vote.

In the hardware game, Samsung has taken the fight right to Apple, even going as far as taking shots at the iPhone directly in a new commercial marketing campaign. While Samsung hasn’t caught up to Apple completely, they continue to gain ground in smartphone sales. With Apple’s foray in to the streaming television market with its Apple TV, it has failed to gain significant ground against other players. Google’s Chromecast provides a similar service on the cheap and Sling TV presents live television streams that the Apple TV doesn’t offer. The product line has not been updated in years, and analysts wonder whether it might be time for Apple to pull the plug on its television experiment.

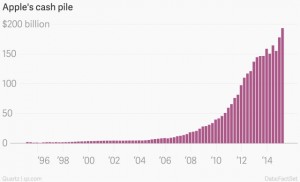

Cash is king

Cash is king

No company in the world may have as much cash sitting in the bank as Apple. With $178 billion in cash to spend the company could go in any number of directions. Activist investor Carl Icahn has been adamant about the company returning that cash to shareholders in the form of a stock buyback or dividend payout, but CEO Tim Cook has kept his plan for the excess capital under wraps, and no one seems to know what the company will end up doing with all its reserves. Icahn feels that with this much capital the company doesn’t have to choose between growth and pleasing investors, it can do both. This plays a key role in the future of Apple, where investors are seeking returns and product-lovers are looking for a research and development push to make even more innovative products.

Conclusions

The potential is evident; Apple is a company that continues to be the cream of the crop in the minds of consumers. Their innovative products and pipeline will always garner attention, but it is whether consumers continue to purchase the company’s products that matters. With competitors like Google and Samsung keeping up with Apple step-for-step, it might be time the company puts that excessive amount of capital they have in their back pocket to good use. That could hold the key to Apple becoming the world’s first trillion dollar company.

View, and trade, the 24Option Apple price chart.

Cash is king

Cash is king