Risks and Benefits Of Leverage

by Gino D’Alessio

Leverage is something we hear a lot about but very few traders take the time to fully understand its usefulness, or risk. It is an immensely powerful trading tool, which magnifies both risk and reward. The definition for trading leverage is;

The use of various financial instruments or borrowed capital, such as margin, to increase the potential return of an investment.

Crucially, it can mean investors can lose more than their initial deposit.

Here, we explain that definition more fully;

What exactly is Leverage?

Leverage is the concept of borrowing money to add to your own capital to make a bigger investment. It started with the stock markets and was called margin investing. What happens in the stock market is you place for example, £10,000 with your stock broker and they lend you (or give you the ability to invest) another £10,000. This allows you to invest a total of £20,000, for your initial deposit of £10,000 – which sounds very attractive. So if you have picked the right stocks and the value of your portfolio goes up 10%, you are in a position to make £2,000. That is 10% of your total investment amount of £20,000. Effectively this borrowed money allowed you to make 20% on your initial capital of £10,000. This loan from your broker does come with a small cost, as they are often going to charge you more commission as you are investing with more money. There may also be interest charged on the loaned amount, or charges for keeping positions overnight. At present, with very low interest rates, those fees are minimal, but they are worth being aware of

Increased risk of leveraging trades;

We just saw the effects of an investment using leverage that went well, but let’s look at the possibility of a bad trade. In the above example if the stocks you picked went down 10% you would now lose £2,000 which this time is a loss of 20% on your initial capital. So the risk is amplified, just as the rewards are.

It’s easy to see how using leverage has great benefits when you get it right but it may also punish you just as much if you get it wrong. Our example followed a simple 2:1 level of leverage. Effectively doubling the initial investment. But leverage can be considerably higher than that, possibly as high as 100:1 or greater.

Leveraging Forex trading

In the FX markets leverage works the same way. Here is an example; You place your money with a broker and open an account with £5,000. The broker allows you to trade multiples of that figure. If he allows you to trade £25,000 then the leverage you are using is 5 times your initial capital and is called 5 to 1 leverage. You will often see it written as 5:1 which means that for every £1 you place in your account you will be able to trade on £5. Most FX traders will look to make day trades or trades that last a short period of time and take a small percentage profit in terms of price movement. This is feasible precisely because of the leverage being used. You may only need to be in an FX trade for 20 or 30 pips (price points) before you take your profit. 30 pips in GBP/USD (known as Cable) is less than 0.20% in terms of overall price movement. That is an incredibly small move – but if you are using 10:1 leverage you now have a percentage move of 2% compared to your initial capital.

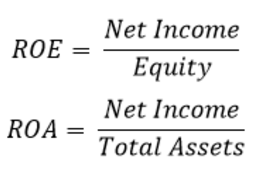

The return including leverage is known as the Return on Assets (ROA). Assets in this case, equal the actual size you trade in. For the example above it was £25,000 and the return was 0.20%. The return on your initial capital is known as the Return on Equity (ROE), and the equity in the above example was £5,000.

The return including leverage is known as the Return on Assets (ROA). Assets in this case, equal the actual size you trade in. For the example above it was £25,000 and the return was 0.20%. The return on your initial capital is known as the Return on Equity (ROE), and the equity in the above example was £5,000.

So to find out the return on the initial capital we can use these simple formulas;

How much leverage?

Most FX brokers offer significant levels of leverage. It is quite common to see leverage of 200 to 1 but some brokers advertise leverage of 1000:1

How much leverage you want to use really depends on your trading style. Style in this sense has a lot to do with how long you keep your positions open. The longer you keep your position open the higher the level of risk you are taking. This is simply because there are more chances of the FX pair moving further away from its current price. If you hold a position for a few minutes you will usually not see the price move very far from the open price of the position. Of course that is not the case if you open a position just before data releases.

You need to consider how long your average trade is going to be live. Is your trading strategy going to keep you in a trade overnight? Or even over multiple days? If so, then you may need to consider lower levels of leverage. Cable can move 2% fairly easily within a few days. If your trading strategy is going to have you with open positions over that time frame a 10:1 leverage could see you lose 20% of your initial capital.

If you’re trading style indicates that your positions remain open a matter of minutes then you are generally going to see the market move within a 30 pip range. In the case of cable that represents approximately a 0.20% move but multiplied by a leverage of 10:1 would mean a 2% move. In this case 10:1 doesn’t seem to be too excessive. There will of course be larger moves – even in just a few minutes – so traders must judge their own risk appetite. Obviously using 200:1 leverage can have disastrous effects. A move of 30 pips could change your account balance by 40%, it would feel extremely gratifying if you’re in profit, but a 40% loss could be catastrophic.

How leverage can accelerate growth.

A profitable trade of 2% is an excellent achievement. The compound effect can accelerate growth even further. Assume you can place 1 trade a day and make a profit of 2% from 30 pips. Thanks to leverage, in 20 trading days you could have added 40% to your account. In terms of annual growth, it represents a 480% return. If such growth allowed you to increase the initial equity, trading volume could be accelerated even more quickly. The same level of leverage however, could erode equity just as quickly.

How to Use your leverage

Leverage has to be considered as part of your risk management rules. You also need to consider how you split your use of leverage up. In our example above, we demonstrated using £25,000 leverage on £5,000 of initial equity. That leverage however, can be split over multiple trades. So five trades could be placed with a value of £5,000 each for example. These could be used across multiple assets or currency pairs – or alternatively, used on the same asset, but at different entry points. Placing just one trade and maxing out any leverage is the same as putting all your eggs in one basket.

So leverage is a means by which investors can maximise the returns on their capital. But the increase in potential reward comes with an increase in risk too, and it is important for traders to know exactly how much financial exposure they have at any one time – including the leverage.

Further Reading;