eToro (Operating as eToro UK Ltd in the UK) are a rapidly growing social investment broker. The brand were pioneers of ‘social trading‘ – the practise of trading socially, sharing trading knowledge and giving users the ability to follow other traders – and profit from their trades. This is also known as Copy Trading.

65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

“eToro make trading accessible. From Bitcoin to the price of oil – eToro allow retail investors access to a full range of markets in a no nonsense way.”

The firm are quick to adapt to trader demands, recently adding a Cryptocurrency fund which gives users quick and easy access to Bitcoin, Ethereum and 5 other cryptocurrencies. This flexibility has, in part, led to the rapid expansion of the firm.

Social trading requires depth of traders. eToro currently has 4.5 million traders, meaning there is a wealth of trading knowledge and no shortage of social interaction. The firm is regulated by the Financial Conduct Authority (reference 583263), giving UK consumers the maximum amount of confidence.

Jump straight to the eToro “How to” guides.

- Demo Account – Yes ($100,000 trading balance in the ‘virtual portfolio’)

- Minimum Deposit – $200 (around £140).

- Minimum trade – $25 (around £18)

- Signals service – No

- Mobile App – Yes, all platforms.

Trading Platform

The eToro trading window has been designed for simplicity and ease of use. The virtual portfolio (demo account) is opened for traders immediately, giving quick access for traders to get used to the platform before carrying out any ‘real money’ trades. The new platform has replaced the old ‘WebTrader’ view.

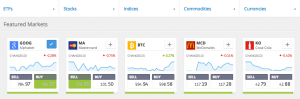

There are numerous routes to get to a trading window. The left hand menu gives traders access to their account details, including their portfolios (both virtual and real) and their bespoke ‘watchlists’. Trades can be opened by simply selecting the asset within either of these windows.

Alternatively, traders can select the ‘Markets‘ menu option. This opens up the full range of assets available at eToro. The markets can be filtered by category – Stocks, Commodities, Currencies and indices – and further filters can then also be applied – for example, traders may want to see stocks from just the ‘Technology’ sector.

Once the desired assets are listed, selecting any of the markets will open a new window showing the latest conversations regarding that asset, as well as an option to look at the latest price charts. Clicking the ‘Trade‘ button then opens the trading window.

Webtrader

Other Useful Reviews: eToro at DayTrading.com

The trading window contains a lot of information, but the design ensures everything is clear. The Sell or Buy button is at the very top, followed by the asset, with the current value. The price movement for that trading day is also shown. To the right is a drop down list that allows traders to place an ‘order‘ if they want to wait for a specific price, or if the local market for that asset is currently closed. The default setting is ‘trade‘ – to open a trade immediately.

Beneath the asset information is the trade amount box. This can be amended via the -/+ buttons, or overtyped. Under the amount are three boxes – these will update as the amount is amended. The first is the stop loss – the point at which a trade will be closed if the price moves against the trader. This is a key field for managing risk. Amend the figure up or down as required.

Leverage

The centre field controls leverage. Traders should fully understand the additional risk leverage entails before using this feature, but it is possible to trade with substantial leverage – even higher on certain foreign exchange pairs.

The leverage will also influence the costs of keeping a trade open overnight, or at weekends. Where markets are open over the weekend (forex, foreign indices and commodities) eToro will offer weekend trading.

The number of ‘units‘ that the trade will purchase will update depending on the trade amount, and leverage band selected. There is then a ‘Take profit’ field, which is a point at which the trade will be closed, if a certain level of profit has been made. Clicking the trade button at the foot of the window will confirm the trade immediately.

The trade will then be visible in the portfolio area.

When traders first open an account at eToro, there is a useful wizard that introduces traders to all the relevant screens and guides them through making a ‘virtual money’ trade. It is a great way to make new traders familiar with the tools and screens. It can be accessed again at any time from the help menu.

How to use Copy Trader

The key feature for the social trading platform however, is the copy feature. If traders do not understand a particular asset themselves, they can profit from someone who does. This is the main draw of eToro. Many users will not actually trade themselves, they will simply invest in other traders who they believe will make profits.

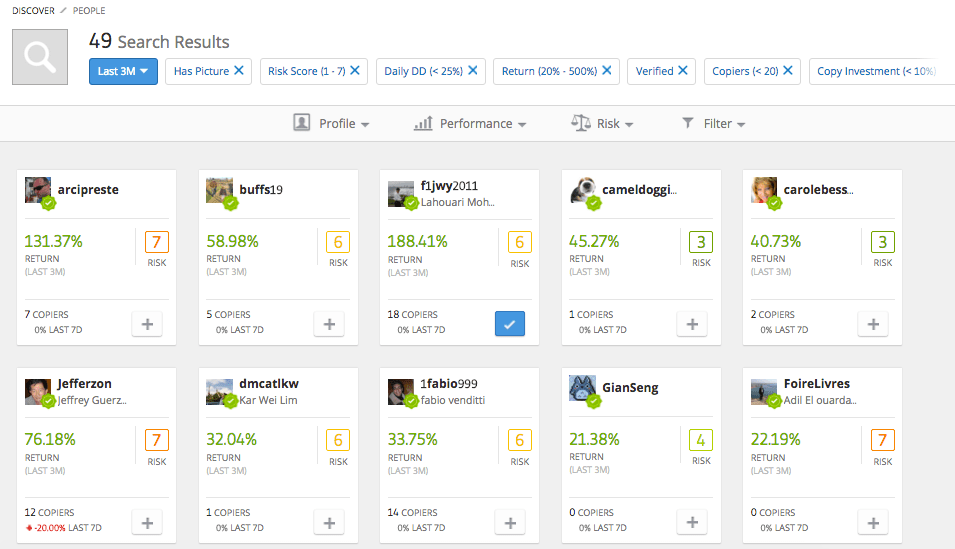

In order to copy a trader, users first need to search for the people they most want to know about. The ‘People‘ menu option, opens up a huge database of all the traders on eToro. From here users can begin to filter down the results to find exactly the traders they want to copy.

Traders can be filtered by location, the assets they invest in, their performance and their recent activity. So if a user wants a UK based commodities expert, who has made at least 10% profit in the last 6 months – eToro will find a range of traders that fit the bill – in seconds.

Results can then be filtered even further based on a whole range of values including risk, trading size and recent activity.

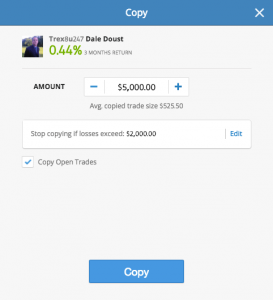

Individual traders can then be selected for closer analysis. Message boards, monthly trading performance and the current portfolio can all be double checked. Once a user has found a trader they wish to copy, they simply select the ‘copy’ button.

The copy screen is incredibly simple. The user needs to enter the amount they wish to invest, and a stop loss figure. They can also choose to open all the trades that the trader already has open – or none of them (and only wait to follow new trades). Those are the only choices the copier needs to make. Selecting the ‘Copy‘ button commits that amount to copy that trader.

Whatever trades are made will be emulated on the the user’s account, with figures amended relative to the amount the user selected to ‘copy’ with. It could not be simpler to profit from established traders.

Traders who are copied themselves, earn additional commission from the broker, based on the number of traders who follow them. So the setup is attractive to investors new to the markets, as they can follow market veterans.

While experienced traders are also able to boost trading profits further, meaning everyone wins. eToro profits from their ‘spread’ or margin on each trade – they make a small percentage whether a trader wins or loses. But the firm know winning players will trade more often – generating them higher income – so they want to see players making a profit.

Asset Choice

The asset choice at eToro is very good. Stocks are a clear strength. There are over 250 companies from around the globe available to trade. Elsewhere, there are over 30 currency pairs, including all of the major Forex currencies. There are 10 indices available and just 3 commodities – this list is likely to get expanded.

Cryptocurrency trading has also seen massive expansion at eToro, with over 15 crypto currencies currently traded, including Bitcoin, Bitcoin Cash, Ripple and Ethereum. Those looking to trade crypto are well served at eToro, and it is certainly one of the best options at present.

Cryptoassets are highly volatile and unregulated in the UK. No consumer protection. Tax on profits may apply.

eToro Fees

eToro make a small charge for leveraged positions held overnight, or over the weekend. This is standard practice for CFD brokers. This reflects their own costs in maintaining the position. The larger the trade (once leverage is considered) the larger the fee will be.

As an example a $10,000 position with no additional leverage will not incur a nightly charge. If the same trade had X5 leverage (so the position effectively totals $50,000) then a nightly fee of £8.48 would apply. The fees represent a tiny proportion of the overall trade value, but are worth being aware of if traders are planning to leverage a long term trade.

Mobile App

eToro offer a free mobile application and tailor the app based on the operating platform, meaning the user experience is optimised. The eToro iphone (iOS) version requires version 6.0 or above, while android needs version 2.3 and up.

The application itself attempts to emulate the trading look and feel of the full website. The searches are clear, and viewing areas large. The full range of assets available on the website are also there on the mobile app.

The app shows a full trading history, and all the live prices are available – as are the familiar searches for ‘Markets’ and ‘People’.

Trading accounts can be funded from the application and there are also some charting features included, which makes research possible ‘on the go’. The whole service is designed to make trading easier, and the mobile app compliments that aim.

The most recent upgrade (to both iOS and android versions) reduced the overall ‘footprint’ of the app, making it 50% lighter – but also much quicker. With speed being crucial for those quick trading decisions, the regular improvements are a great strength.

Payout

The payout details at eToro are not comparable to binary options brokers. Payouts will be scalable based on the leverage applied and performance of the asset. For this reason, traders must understand the risk in each trade.

Spreads are ultra competitive, and the firm ensure they are as tight as they can be. They recently reduced the spreads on Australian markets including AUD currency pairs. Some were reduced 300%.

The trading platform includes risk management elements such as stop losses, so that traders can control their risk. This is an important distinction from traditional binary options, where the risk is known with absolute accuracy.

Withdrawal and deposit options

There are a wide range of options to fund a trading account at eToro. Supported methods include debit card deposits (such as VISA, Mastercard etc). A full range of eWallets (UnionPay, PayPal, Skrill, WebMoney, Neteller and Yandex) and of course the more typical wire bank transfer is also an option

There is a minimum withdrawal of $50, which is fairly typical. A withdrawal will generally take 3 days. eToro charge a withdrawal fee of $25 for every withdrawal made. This is quite steep and higher than many rivals charge.

In addition, foreign currency conversion incurs a further charge ranging from 50 to 250 pips. This is again, rather unfriendly to the trader.

Withdrawals need to be made back to the same method as the initial deposit. This is to comply with Anti-money laundering laws. For the same reason, eToro also request certain ID documents before processing a withdrawal:

- Colour copy of passport, including signature

- Copy of a recent utility bill or bank statement (as proof of address)

- If paying with Credit card, a copy of front and back, with CVV covered along with final 8 digits of the main number.

One down side to the eToro withdrawal process is the charges. Rival brokers allow one free withdrawal per month or do not charge at all. eToro charge $25 for any withdrawals. This is something the brand could look to improve in our opinion.

Complaints

eToro suffers relatively few complaints. One repeated issue is disgruntled copy traders who were disappointed when the trader being copied did not perform as they previously had in terms of profit. This is not a fault of the broker themselves.

Withdrawal delays can cause some disputes, but new clients ensuring they complete their verification steps, can ensure there are no further hold ups when a withdrawal is subsequently requested.

The platform is extremely reliable and problems with connections or website availability are generally an issue at the client end, rather than the eToro servers.

Demo

Here is a brief video about eToro and Social trading;

Other Features

eToro offer their clients the following features and benefits:

- Charting– eToro off candlestick charting, available via each asset screen.

- Learn More – eToro have an in depth learning area where traders can learn about the tools within the platform.

- News Feed – Tap into the latest news from Social media and see how other traders are viewing particular assets.

eToro is certainly a unique offering. For those looking to profit from trading, but without the skills or confidence to go it alone, the copy trader function is an excellent way to get introduced to the markets. Once a trader is more comfortable, they can begin making their own investment decisions.

For experienced traders, we feel the offering from eToro could be expanded, to allow more research and possibly advanced charting – the attraction for established traders of course, is the ability to make even more money on trades, by attracting followers. The social trading concept is one that is well worth investigating, and with a default virtual account, the platform can be trialled risk free.

CopyTrader™ System

eToro’s CopyTrader™ system is the perfect solution for traders who lack the time or experience to trade, by enabling them to attach some of their funds to other traders, copying every move they make in real-time. eToro works in full transparency, making each client’s portfolio, track record, fail/success ratio, and Risk Score available for all to see. Clients can use the “People Search” tool, and filter results according to Risk Score, asset classes, gain, and more.

Popular Investor Program

Successful eToro traders can apply (there are criteria to be met first), and receive Popular Investor status. Once accepted into the program, traders could rise up the levels. These range from Cadet to Elite Popular Investors. Each level receives great perks along the way, such as:

- Monthly payments

- 2% of Assets Under Management (AUM).

All payments to Popular Investors are real, immediately withdrawable funds.

CopyPortfolios™: A Brand New Financial Instrument

CopyPortfolios™ are a brand new way to invest online. There are two types of CopyPortfolios™: Market CopyPortfolios, which group several assets following a predetermined trading strategy, and Top Trader CopyPortfolios, which group successful eToro investors together.

Each fund is managed by a sophisticated algorithm to optimize the fund. With each fund composed of multiple elements, diversity and risk management are improved hugely.

The Copy portfolio feature offers the chance to follow a range of active traders, selected based on performance by the portfolio algorithm. Each trader is followed using a percentage of the fund capital, and those allocations will change based on performance. It is an interesting concept which reduces risk for the copying trader, and offers access to the best performing traders, without the need for constant monitoring of performance.

Market Copy Portfolios

An alternative to copying a range of traders, is to copy a range of assets within one asset class or category. For example, banking or technology. For example, the firm offer a fund based on “TheBigBanks” or another which gives the trader exposure to US based ETFs.

The concept is again appealing to traders who want exposure to a particular asset class, but do not want to setup a range of different copying trades. Now, they can get more diverse exposure, in a fraction of the time. There is even a fund that goes short across a range of assets, enabling traders to hedge against market crashes.

The list of portfolios is being added to all the time (with the broker taking requests from traders). So if there is no fund covering emerging markets, just ask.

Crypto Copy Portfolios

eToro have released a very topical new portfolio, focussed on Crypto currencies. The fund includes Bitcoin and Ethereum (These are available to trade individually), but also Ripple, Litecoin, DASH and others.

Investing in crypto currency has not been straight forward up until now. There are technical challenges as well as risk factors to try and manage. The eToro fund allows traders to gain access to an extremely popular sector at the click of a button. It is another sign on the firm delivering the investments that their customers want. They have seen crypto currency trading increase 400% in 12 months!

The portfolio, will be regularly analysed and then auto-rebalance once a month by an investment committee. The innovative fund will offer investors a diversified portfolio weighted according to market cap size.

Yoni Assia, CEO and co-founder of eToro had this to say on the new release:

“This CopyPortfolio is the first of its kind globally providing investors access to the world’s biggest digital currencies in one innovative portfolio. For those who believe in the technology’s potential, this is an opportunity to invest in a straightforward and simple way.”

CRISPR Copy Portfolio

CRISPR is the latest biomedicine achievement which has the potential to allow medical professionals to ‘edit’ DNA. Commercial uses would be almost boundless. From eliminating gene based diseases to changing physical attributes, the knowledge is ground breaking.

eToro recently launched the CRISPR CopyPortfolio, to enable clients to invest in this emerging industry that is revolutionising biotech. The CopyPortfolio launch created huge interest in early 2018.

The CRISPR CopyPortfolio comprises leading companies who are investing in this technology. The portfolio is rebalanced on a specific schedule to include the best exposure of technology available on eToro. The minimum investment amount for the CopyPortfolio is $5,000 – but there are no management fees.

Cryptocurrency Wallet

eToro have recently gone live with a crypto wallet service of their own. This allows their 10 million registered traders (and new customers), to buy and sell a range of cryptos, convert them, trade them and pay for services with them.

The wallet will be rolled out on a phased basis, so more and more customers will have access, and more and more cryptos and features will be released. This method ensures high levels of performance can be maintained as the application scales up. The app is available from both Google Play and the Apple App store. Platinum members will already be able to use some of the future tools within the app.

High security is maintained with multi-layer protection. The setup does however, allow traders to see their blockchain transactions, without having to expose their private key (security algorithm).

The wallet keeps eToro at the forefront of Cryptocurrency trading and makes accessing this complex market much easier for retail traders.

eToro “How to” Guides and Further Details:

Are profits taxable?

The answer is generally “no”, but traders do need to be aware of the position HMRC takes. Read a full, detailed response in this article on UK tax and binary options, written after consultation with HMRC.

Regulation

eToro offer contracts for difference (CFDs). These financial products are regulated by the FCA (Financial Conduct Authority), so UK consumers get a strong level of protection when trading at eToro.

eToro (UK) Ltd represent the UK based arm of the firm. They are registered at Companies House. Being regulated by the FCA (View details) ensures UK consumers have access to official channels for disputes. Or in the event of financial issues with the firm. So consumers can raise problems with the Financial Ombudsman Service, (to raise disputes) or the Financial Services Compensation Scheme (If eToro UK Ltd cease trading for any reason).

The consumer protection is far greater than at the majority of binary options brokers, and means UK investors can use the firm with absolute confidence.

Trading hours

The eToro website is available 24 hours a day, but particular assets will only be available to trade when the market is open for that asset. So Stocks listed on the London Stock Exchange will be available during UK trading hours – but not outside of those. Outside of trading hours, it is possible to open ‘orders’ which will then be fulfilled when the market is next available. Traders need to select the price they are happy to trade at, and orders will be filled once the market is open and the price set is available.

How to find traders to copy

Finding traders to copy is simple, but does require some time and research in order to find the right trader for you.

From the Copy Trader screen, users are presented with a number of filters in order to narrow their search. These include:

- Location

- Market

- Profit / Performance

- Timeframe

eToro will also list the most copied traders, those with low risk or those trending.

It is important not to be drawn in immediately by a huge short term profit figure. One profitable trade may have masked 2 or 3 years of losses. So in order to find the more consistent traders, it is worth setting the ‘timeframe’ filter to a long term setting (one or two years). The handy ‘risk’ score, is also a very quick guide as to whether that trader fits the trading requirements of the user. (Risk score is explained in detail in a separate FAQ below).

Once a few candidates have been shortlisted, each can be clicked on to get a view of their past performance. Profits are broken down per month – this gives a great overview of consistency. Regular monthly profit is, of course, desirable – but the odd negative month is not a show stopper.

Users need to determine what they are looking for in a trader. A trader making regular monthly gains of 3% or 5% would be great, but some might be looking for a higher risk trader, who goes through sharp performance swings – hoping to catch them during an upswing.

So there is no right or wrong answer in who to copy, it will be down to the individual – but the more time invested in the decision of who to copy, the more likely that a user will find the right trader.

How to place a trade on the platform

The eToro trading platform is fairly simple and intuitive, but it is worth running through how to open a trade.

Essentially there are just three steps to opening a trade:

- Identify the asset.

- Click ‘Buy’ or ‘Sell’ to open a trade ticket (Or view the asset details and select ‘Trade’ from there).

- Confirm the trade details, select ‘Open trade’.

Firstly, find the asset to be traded. This can be done via a personal watchlist, or a brand new search. Click on ‘Trade Markets’. This will open a list of popular assets. These can be filtered by category via the tabs at the top of the screen (‘Stock’, ‘Indices’ etc). eToro then groups assets further, by location for example, or sector – such as ‘Technology’. Use the filters to find the asset of interest.

Once found there are a number of way to open a position. Traders can click on the ‘Buy’ or ‘Sell’ buttons to open a new trading ticket, or click on the asset logo to see more detail. The additional data includes the price chart, and also the feed – so traders can see what others have to say on that asset. From the detail screen, select ‘Trader’ to open a ticket.

Once found there are a number of way to open a position. Traders can click on the ‘Buy’ or ‘Sell’ buttons to open a new trading ticket, or click on the asset logo to see more detail. The additional data includes the price chart, and also the feed – so traders can see what others have to say on that asset. From the detail screen, select ‘Trader’ to open a ticket.

With the trader ticket open, traders need to enter the amount they wish to invest, and then set the stop loss, leverage and take profit levels. Any overnight or weekend fees are listed below the ‘Open Trade’ button. Once a user is happy with the settings of their trade, they simply click ‘Open trade’ and the position will be added to the portfolio.

What is the eToro risk score?

The eToro risk score is a measure of market exposure that eToro give to each trader. The number is between 1 and 10, where 1 is very low risk, and 10 is very high risk.

The firm calculate this number via a number of measures. For example, they will consider whether the portfolio is diversified, whether the instruments and assets being traded are particularly volatile (or not) and most importantly, the levels of leverage and equity being used.

So for example, if a trader has their entire portfolio invested in three trades, all forex pairs including the US dollar, and all in the same direction, with the highest possible leverage – eToro will give them a high risk score. If another trader has invested 60% of their account balance across 20 different trades, with no leverage and a broad range of instruments that are not particularly volatile, they will get a low risk score. Even lower if some of those trades effectively ‘hedge’ each other (Perhaps the trader has brought some ‘safe haven’ assets to hedge some stock positions.)

As ever in investing, there is no clear “right or wrong” way of doing things, but the risk score does at least give traders a good idea of the risk appetite that another trader might have, meaning they can copy traders with similar investing aims to their own – or at least ensure they understand the level of risk they might be taking copying a certain trader.

Fees

eToro fees vary based on the instrument. For example, on Forex the spread will be 3 pips on the EUR/USD pair, but 7 pips on the EUR/AUD. The overnight fees will also vary. eToro also state that spreads might change based on trade volume and volatility. Overnight fees are not applied unless leverage has been used.

So calculating an accurate fee per trade might be quite difficult, particularly if the length of time the position will be open is unknown. Generally the spread and costs will amount to 0.5 to 1% depending on leverage.

The firm also charge a withdrawal fee. This is a flat $25 on all withdrawals.

They also apply a fee on dormant accounts. An account is deemed dormant where it is not used for 12 months. The fee is $50 per month. Open positions will not be closed in order to pay this fee.

How To Copy Traders

Copying traders is a key feature at eToro. It enables traders without the time or knowledge to copy the trades of successful eToro users. Here we explain how to copy traders on eToro.

Copying traders is a key feature at eToro. It enables traders without the time or knowledge to copy the trades of successful eToro users. Here we explain how to copy traders on eToro.

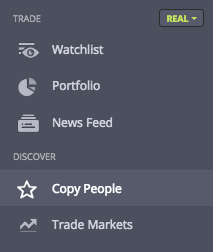

Firstly, find the Copy People option on the user menu on the left of the screen. This opens up the copy area. Along the top of this screen are a number of filters. Each can be set to help users identify the traders they want to copy.

Filter Traders by:

- Location – Find trades based by region

- Market – Find traders who trade specific assets, for example forex or stocks

- Performance – The last two filters are based on profits over a specific period

These can be tailored to narrow the search quickly and lead users to copy the right traders.

Further down the page, eToro will list certain traders based on current short term performance, those getting copied the most, or those with a particular risk profile. These are labelled ‘Top Investors‘.

If the user has found a trader of interest, they can click on the name to see more detail about the trades placed by that trader. Figures are broken down by month, and go back for as long as the trader has been making trades. Long term, consistent profit is a good sign. Users can also see the current portfolio. This shows if the trader is active and what current positions are open (and could therefore be copied straight away).

If the user has found a trader of interest, they can click on the name to see more detail about the trades placed by that trader. Figures are broken down by month, and go back for as long as the trader has been making trades. Long term, consistent profit is a good sign. Users can also see the current portfolio. This shows if the trader is active and what current positions are open (and could therefore be copied straight away).

Once a user has found a trader to copy, they can click the ‘Copy‘ button from within the profile of the trader. Users will then need to confirm they understand that eToro will open and close trades on their behalf once they confirm the intention to copy a trade.

There is then one final step – but the most important. The final copy screen confirms the size of the investment the user wants to invest with this trader. The screen will confirm the average size of investment, based on the amount set by the user. In our example, a $5000 copy will involved average trades of roughly $550. Those copying need to know exactly how large their investments might be.

eToro Copy Trader budgets

There is then a stop loss figure, where copy traders can stop copying if losses hit a certain point. There is also a tick box to indicate if the user also wants to copy the existing positions. If ticked, any open trades will be copied immediately. If not ticked, the copy process will wait for any new trades to be opened.

Once confirmed, the copied trader will appear in the user’s portfolio, listed just like any other asset. The performance is listed, and from the settings buttons on the right, the copy position can be adjusted, or ended.

Once confirmed, the copied trader will appear in the user’s portfolio, listed just like any other asset. The performance is listed, and from the settings buttons on the right, the copy position can be adjusted, or ended.

That is how to copy traders at eToro!

Step by step guide to Copying traders at eToro

- Open the ‘Copy People’ menu option.

- Use the filters to narrow the search.

- Review the shortlist, and the lists provided by eToro.

- Research individual traders. Look for consistent profits.

- Select the ‘Copy’ icon.

- Enter the amount to invest copying this trader.

- Confirm and check the details within the Portfolio

65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Additional Reading

If this eToro review did not answer all your questions, below are some additional great sources of information.