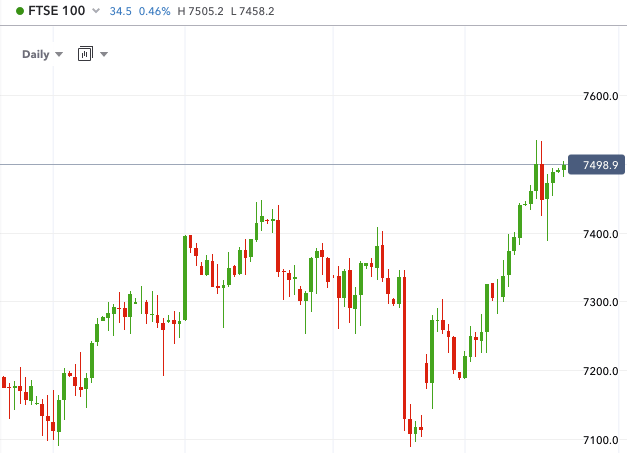

FTSE 100 hits a second day high in a week

The FTSE 100, Britain’s primary benchmark share index, broke a fresh trading record for two days in a row this week. Early in trading on Tuesday 16th, it hit 7,478 – gaining 0.3 per cent and exceeding the previous peak on the Monday of 7,460.

Reasons For FTSE 100 Bull Run

So what caused the peak? Early on, Vodafone gained an impressive 3.8 per cent after an announcement that its board had agreed to an increased dividend, and the release of solid numbers after a previously difficult year.

However, EasyJet, the budget airline, traded at a 6 per cent loss after announcing its pre-tax losses of £313m – in line with its earlier predictions but still well in excess of the loss of £21 million from Q1-Q2 of 2016. It blamed unfavourable currency fluctuations on an £82 million income hit, along with the impact of a later Easter.

FTSE 100 Daily Chart

Falling Pound Boost Multi-Nationals

The new record high for the index is the latest in over 12 peak records that it has achieved since last Christmas. The ongoing drop of pound sterling continues to provide benefits. The Pound has been weak since the referendum announcement last summer. It actually benefits the FTSE 100 as many of the companies within the index have substantial overseas operations and investments.

In fact, around 70 per cent of revenue for the index’s companies is derived from overseas sources, making weak sterling favourable for inflowing income. Why? Because the FTSE 100 is heavy with oil firms, mining companies and big pharma companies that keep their HQ base in the UK but tend to operate and denominate their trading assets in American dollars.

European Downturn?

Meanwhile, European stocks were in retreat after disappointing updates on earnings from big pharma and banking giants. The Stoxx 600 dropped by 0.1 per cent and the DAX index was trading flat. Among the weakest industrial sectors was healthcare, which dropped by nearly 8 per cent after BTG published its disappointing year-end figures.

Meanwhile back in the UK, inflation jumped again last month and reached its highest level recorded since 2013 at 2.7 per cent – up from 2.3 per cent in March. This is primarily down to the fall in pound sterling which is now filtering though to the price of British goods.