What is behind the 2017 FTSE rally?

FTSE Rally

2017 has been a good year from January to July for the FTSE 100 overall. Commencing the year with a fierce climb upwards, it broke to a then new high of 7,415.95 by the middle of March 2017. Although there was a dip toward the end of the same month and the end of June 2017, it has since resumed its steady progress upwards.

If you look at this in comparison to last year, the difference is stark. The clear upward trend to gain around 20% from last year’s level shows that the FTSE 100 rally is still underway and has strength left in it.

Federal Reserve

But why has the FTSE rallied so strongly in 2017 compared to the previous year? The first factor that has helped greatly is the cautious approach of the Federal Reserve. Earlier in the year, their fairly dovish approach had seen them lift their fund’s rate very gradually which had the effect of not panicking investors in assets such as stocks and bonds.

The knock-on effect of this was that the US dollar became weaker which made commodities, which are priced in dollars, more attractive to buy. The FTSE 100 has great investment exposure to brokers who deal in commodities so this naturally has had a positive impact.

Dutch Reject Wilder

The second factor was the result of the Dutch election. As we now know, Geert Wilder’s right-wing party did not win, which heralded a huge sigh of relief in financial centres across Europe. As well as the Euro climbing on this result, stocks did too which had another positive impact on the FTSE.

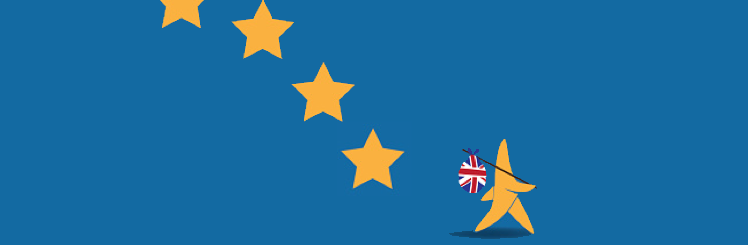

Lastly, the uncertainty around Brexit had seen the pound grow weaker for a period. This actually benefited the FTSE as most of the revenue generated on it is from overseas, so when the money came back into the country, it was worth more in effect.

Although we cannot say for sure that the FTSE 100 rally that we have seen in 2017 will carry on, it is worth looking at these signals to understand why it has been such a good year for it so far.