IQ Option are one of the largest, and fastest growing, binary options and forex (FX) brokers trading at present – find out why here.

- How to use the platform

- The benefits of the mobile app

- Payout information

- Which additional features to make use of

This material is not intended for viewers from EEA countries. Binary options are not promoted or sold to retail EEA traders.

Despite being relatively new to the sector, having formed in 2013, IQ Option have grown rapidly. This growth was due, in part, to offering low minimum deposits – making trading accessible to large numbers of traders, and ensuring they offered a smooth, enjoyable trading platform. In their words “the ultimate trading experience“. Strong affiliate partnerships boosted growth at a record pace.

CFD, Forex and Bitcoin

Since being founded, the firm have expanded beyond pure binaries. They now offer traditional forex trading, and also cfds. They led the way in cryptocurrencies, offering a range of crypto trading choices.

In addition to these new trading options, they also added risk management features. Tools such as stop losses and take profit have been added to ensure the forex and cfd traders have all the advanced features they would expect with leveraged products.

IQ Option are not a scam. The firm have started to collect some of the more prestigious awards in the sector – including ‘Most reliable binary options broker‘ in 2014, from MasterForex-V. The brand continues to grow and innovate and traders will be offered a demo account (practice account) immediately on registering, without the need for a deposit.

- Demo Account – Yes. Available to anyone via the demo login. No time limit and balance can be reset as often as required.

- Minimum Deposit – £10

- Minimum trade – £1 (Maximum trader variable)

- Bonus details – None.

- Mobile App – Yes. IQ provide an excellent mobile trading app. These are covered in more detail below.

Trading Platform

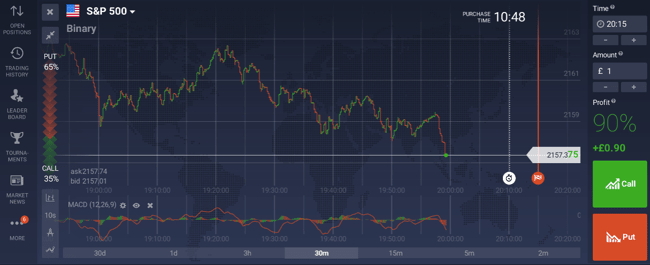

Platform Review

It is a visually stunning platform, and sets the gold standard for binary options brokers.

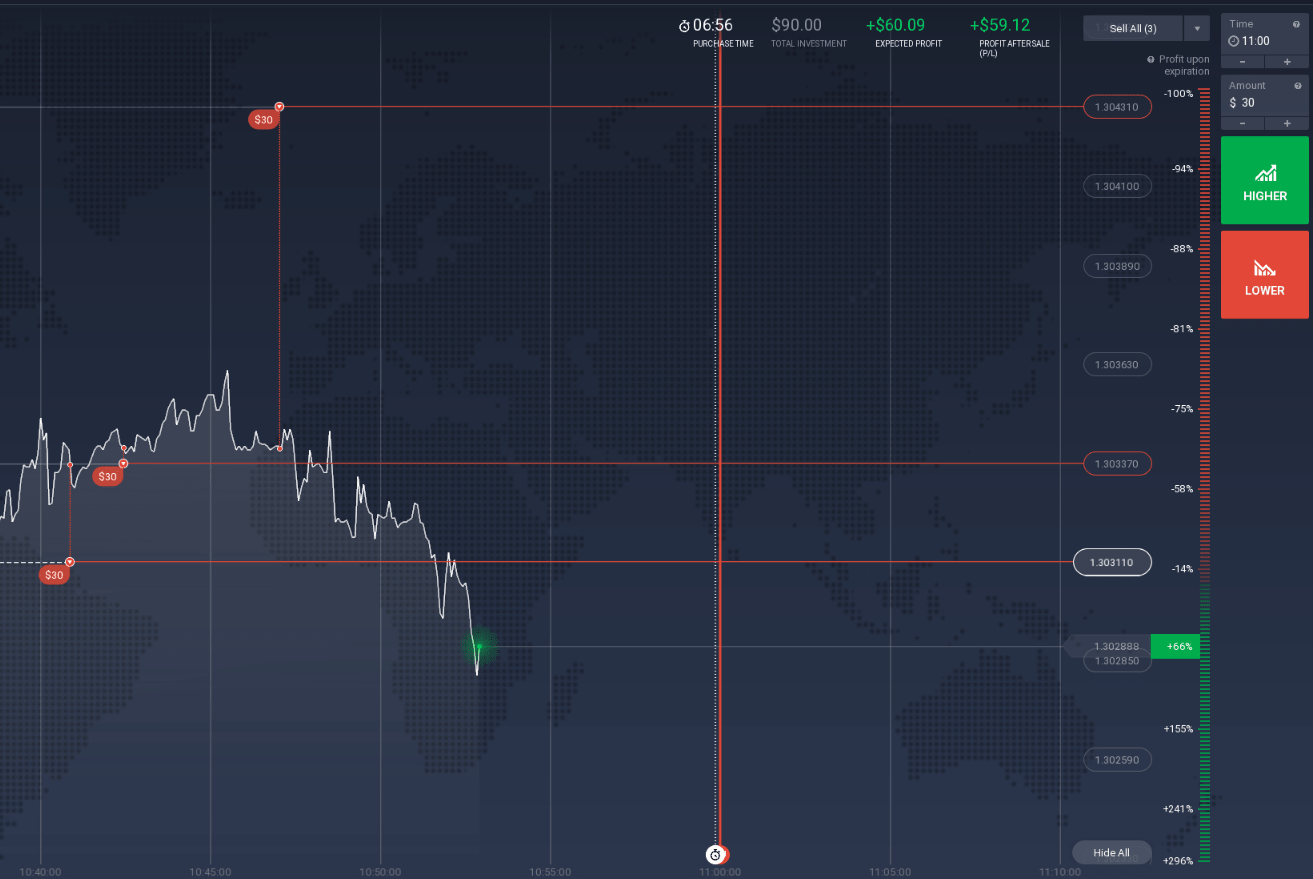

It is a fully configurable platform. Traders can arrange trading windows as they wish – focus on just one, or manage a whole range – whatever suits the trader best. Our screenshot illustrates one ‘main’ window, with three other assets underneath. All can be traded simultaneously.

The price graph makes up the main part of the trading platform. But down the left hand side of the trading area are the navigational buttons to move to different areas of the website (these can be collapsed when not required) – and alongside those are some powerful technical analysis features.

New technical analysis tools have been provided, and these are available from a small menu at the bottom left corner of the price graph.

- Plot Type

- This option allows traders to amend the graph to a format they prefer to work with. Options include the traditional candlestick, line and bar charts – in addition to the default area graph. Each can be tailored in terms of colour and appearance.

- Time Interval

- This is an added area of flexibility. It is surprising how many brokers overlook the fact that traders may want to expand or collapse the time frame of the price graph they are looking at. IQ have added a great layer of flexibility for traders to dive into the price charts and map any trends accurately.

- Graphical Tools

- A natural progression from allowing the charts to be expanded, is to allow traders to draw their own interpretations on to charts. The graphical tools allow traders to add trends, or support and resistance lines – the tools can be used however a trader wishes. This is vital for traders wanting to get their timing right – but again, not always something that is provided on other trading platforms.

- Indicators (Technical Analysis)

- Binary options suit technical analysis, and IQ have provided 9 technical analysis techniques that can be overlaid on the price graph. Traders can watch the MACD run beneath the prices as they move, or overlay Bollinger bands. Again, each tool is configurable, so moving averages can be amended to suit the trader. Ever wanted to amend the ‘smoothing’ ratio on the Stochastic oscillator? with IQ option, you can! In all seriousness, these tools are as powerful as any high end CFD or Forex broker and IQ really have raised the bar within binary options.

More Configurable

IQ have added more configurability to the platform, so traders can set their own colour schemes and hide or show menus depending on their preference.

This extends to the trading windows too, where IQ have provided a range of preset layouts to make trading multiple assets much easier.

The Expiry and Amount fields have also had a redesign, with “+” and “-” buttons being added so that expiry times can be pushed back, or brought forward and the trade amount can be clicked higher or lower very easily – without the need to type figures in.

IQ Option also try and add new features to give traders more flexibility. The Position Top-up facility means traders can add funds to a trade to keep it open if it approaches a stop loss. This offers new choices in terms of risk management or trading strategy.

Charts

There are tools to amend the time frame of the chart, as well as the plot type (for example, bar charts or candlesticks etc). The technical analysis features are a great addition – traders can add MACD, Bollinger bands or any of the other 8 analysis tools available. They are added instantly to the chart and traders can refine their trades as they need. \

The drawing buttons allow traders to add freehand graphics to the charts – so they can add trend lines or resistance and support levels.

Just above the new analysis options is the trader sentiment bar. As ever, this shows the way other traders are trading the particular asset. Above that are options to minimise or close the current asset trading window.

The charting offers experienced traders the chance to perfect the best strategy.

Select An Asset

To select an asset, traders can select the drop down arrow at the top of the platform. This will open a new window, where the trader can choose which type of option to use and then select the category of asset (for example forex or indices) and then the specific asset, from eur/usd to Facebook stock. Once selected, the price graph will update for the chosen market.

There are also ‘tabs’ across the top of the trading area where traders can quickly move to assets or markets that they have traded previously. Open positions will also appear as a new tab here – making switching very easy.

The price graph presents all the relevant trading information. The graph itself illustrates the recent price movements, but overlaid on the graph will be vertical lines showing the purchase deadline (the time by which a trade must be confirmed) and the expiration time.

Expiry And Trade Size

There is a ‘Time‘ drop down menu to the right of the graph, and this can be used to amend the expiry time – if changed, the purchase deadline and expiration time will move on the price graph, giving a visual indication of the timings. The -/+ buttons will shift the time to the next applicable time slot.

Also listed on the right hand side are the other key figures for the trade. The trade amount is just below the expiry time – the minimum trade value is just $1. The payout for that specific asset is then displayed. This confirms the percentage returned in the event of a successful trade.

Next comes the Profit indicator, this shows exactly what figure will be returned if the trade is placed – and includes the original investment amount. Finally in the bottom right are the trading buttons.

They are clearly marked, not just with the relevant wording, but with arrows to indicate the trade direction as well – and just incase that were not enough, when each button is hovered over, an arrow will appear on the price graph, to show which way the price will need to move in order for the trade to finish in profit.

Where forex of cfd trades are opened, the layout will differ. Additional information such as leverage and stop losses will appear as and when relevant. Traders can also select a ‘take profit’ level to close their trade at a desired price.

Single Click Trading

The trading buttons at IQ Option are ‘single click‘ which maximises the opportunity for traders to get the price they want. There is no confirmation window or approval delay.

Once placed, a trade will be available in the ‘Open positions’ window, and a line will also appear on the price graph at the strike price. Once the expiry time is reached, a window will appear confirming if the trade was successful or not, and confirm the profit / loss.

It is a visually exciting, smooth trading environment, with just enough configurability to satisfy almost every trader.

While the emphasis is on appearance, the addition of excellent charting and technical analysis tools has raised the bar for the brand – and taken what was already an excellent platform, and turned it into the industry benchmark. Other brokers may offer more trading choice – but none will offer a better trading platform.

Classic Options

IQ Option have released a new form of trading, which they have called “Classic Options”. These retain some of the fixed risk associated with binaries, but allow leveraged profit too. So they are similar to a traditional investment, but with a stop loss built in.

The classic option has no short term expiry, and can be closed at any time. This makes it much closer to “traditional” investing. At present, IQ only provide classic options on US stock assets. They are sure to be a popular feature and therefore expanded with time.

Traders can select a strike price. Each level will change the levels of profit and risk of that trade. A user then chooses the amount of “contracts” they want. The cost will be relative to the strike price, and is shown clearly on the Call and Put buttons.

Open trades a visible from the trade history tab, and can be closed at any time. Current profit and loss on each trade shows the up to date status of the option. Overall the classic options look a great choice for traders that like to use fundamentals rather than technical analysis. As noted above, they ‘feel’ more like a CFD, but with a built in stop loss to manage risk.

Here is a video tutorial which demos the FX option product:

RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Trader choice

The firm have kept adding to their list of assets. In addition, they have also expanded their choice of expiry times – particularly from the binary options lists. End of day, end of week and end of month are now also available. This is a big step for a broker that offered purely short term trades before.

Binary Options – The basic binary option. Will the asset rise in value, or fall? The expiry times on offer with these has grown. Now traders can select from 15 minutes up to end of day, week or even month. Binary Options are however no longer available to retail traders within the EEA.

Turbo – Exactly like a traditional binary option, but with short expiry times. Turbo options are usually available in one minute levels, from 1 minute, up to 5 minutes.

Forex – Traditional foreign exchange, offering per pip payouts. The forex windows offer different leverage levels and competitive spreads. Forex markets mean weekend trading is now available.

CFD – IQ Option offer direct access to some markets via contracts for difference. These include the latest range of cryptocurrency markets, including Bitcoin and Ethereum, among others.

IQ Option will add assets as their users demand it. Recently the Nintendo share price saw a lot of interest, due to the Pokemon Go release. The broker was quick to add Nintendo to their list of assets. This reflects a desire to deliver the products their clients demand. The asset lists at IQ are now very comprehensive.

Cryptocurrencies

IQ have led the way in making crypto trading available to retail traders. They offer trading on a huge range of cryptocurrencies, including the larger, most traded assets such as Bitcoin and Ethereum. These assets are available to trade as CFDs, or using traditional Forex models.

Non-EU traders can also trade crypto another way too – using Crypto Multipliers. These are effectively the same as using leverage, so accelerate profit or loss rapidly. There is a Bitcoin x 100 market for example, where the underlying price is multiplies by 100 – increasing volatility and the potential for profit or loss.

This market proved so popular that IQ Option have added similar products on other leading cryptos, with a range of multipliers, from x20, to x50 up to x100.

IQ Option Mobile App

New iOS version

Apple recently announced changes to the binary market in the Apple store. IQ Option have already responded and developed a new application for iOS that meets the new rules. Compatible with iOS 9.0 and higher, the app builds on the IQ offering.

Forex and CFD trading are available, and the firm will add cryptocurrency asset trading as soon as it is released on the full site. The speed with which IQ were able to respond to the Apple changes was impressive. They have always been at the forefront of mobile trading development. This new offering will be unique within the Apple store until other brands catch up with the new rules.

Android App

The mobile app maintains the simplicity of the trading area on the website, and retains the split second charting that makes trading binaries viable. The layout is incredibly clear, and can be tailored to suit the needs of individual traders.

In addition to the trading facilities, there are also features to maintain account details, including the ability to request withdrawals from the mobile app. The team developed their mobile offering in-house and the attention to detail is evident.

While some trading apps appear to have been purchased ‘off the shelf’ in order to tick a box, this broker has clearly spent some time and effort getting their mobile app right. The recent updates have also taken into account feedback from traders using the mobile app, and appears to be another step forward.

Download the App for iPhone or android

Payout

Payouts at this broker are a clear strength. The most traded assets see payouts of around 85%, with some assets reaching 91%. (Amount will be credited to account in case of successful investment). As ever, the payouts will vary based on expiry times and the asset selected.

Forex and CFD payouts will vary based on the performance of the underlying asset. IQ supply plenty of risk management tools including stop losses and user set leverage amounts.

FX Options payouts also vary based on performance of the underlying asset.

Withdrawal and Deposit Options

Deposits can be made via credit card (all major cards accepted) as well as wire transfer and online transaction services such as Skrill and Neteller. The minimum deposit is just $10 – The initial deposit will dictate which account type a trader moves into. Deposits via Paypal are not available and will result in an error.

Withdrawals are on occasion subject to certain verification processes at IQ Option, including proof of identity. In order to avoid any dispute, it is always better to clarify these requirements before needing to make a withdrawal.

All the verification can then be put in place well before monies are requested. Non verification is the biggest cause of delays.

Withdrawals are available via the same payment methods as deposit – namely credit and debit cards, and wire transfer.

Other Features at IQ Option

The brand offers their clients a range of other features and benefits:

- Technical Analysis Icon – Within the trading area, there are some technical analysis tools incorporated into the user options. These include trend line tools and moving average and Bollinger band indicators.

- Range of Educational material – They deliver a suite of education training videos as well as one to one support on occasion

- Tournaments – Prove yourself among the best traders and gain extra financial rewards for performing in tournaments. The firm run a range of regular tournaments that traders can buy into to increase profit.

- Bitcoin – IQ Option give traders to chance to invest directly in bitcoin and other cryptocurrencies via their latest range of cfd type options. This is a solid option for traders looking to get simple access to bitcoin and ethereum markets – they are not always easy assets to speculate on – until now.

FAQs:

Does the platform require a software download?

The firm provide trading both online, and also with a software download (mac or PC). So traders have the choice. The downloaded software provides a slight speed benefit, but the online trading platform performs very well too. There is also the mobile app for trading on mobile devices – that does require downloading.

Do they have good liquidity?

IQ Option have grown rapidly in the last two years. They now boast over 11m accounts, and provide 3m trades a day. That offers them a huge amount of risk management, and trader reassurance that the trading platform provides a large amount of volume and liquidity.

How do they make money?

The firm make money by balancing trader sentiment (buyers and sellers) and taking counter party risk on each trade. Where there is a significant imbalance in trades, IQ Option will reduce their exposure by offsetting risk with a market maker. We explore how brokers make money in more depth on the brokers page.

Contact Details

IQ Option offer a range of contact methods:

- Email – support@iqoption.com

- Telephone support

Telephone support is offered in 18 different countries including Australia, India, Thailand, Brazil, Germany and Spain. Users needing to unblock, delete or close an account, need to go via the helpdesk. There is also the option of Live chat via the website.

* Amount will be credited to account in case of successful investment

General risk warning: “CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.“