By Gary Smith

By Gary Smith

Thinking of trading the Norwegian Krone? Here’s the big picture…

Is it time to widen your currency trading portfolio? The Norwegian Krone (NOK) offers an interesting prospect. Positioned somewhat outside of the list of the world’s most traded currencies (it sits between Hong Kong and Singapore), NOK is unique in several respects. In terms of trade, Norway’s most significant partners are its European neighbours – and yet it remains resolutely apart from the EU. A non-OPEC member, yet one of the world’s biggest oil exporters, it’s also one of the world’s most stable economies.

Is it time to widen your currency trading portfolio? The Norwegian Krone (NOK) offers an interesting prospect. Positioned somewhat outside of the list of the world’s most traded currencies (it sits between Hong Kong and Singapore), NOK is unique in several respects. In terms of trade, Norway’s most significant partners are its European neighbours – and yet it remains resolutely apart from the EU. A non-OPEC member, yet one of the world’s biggest oil exporters, it’s also one of the world’s most stable economies.

But at the same time, the tag, ‘safe haven currency’ doesn’t sit too comfortably with NOK – at least not over the last couple of years. The oil price slump has taken an inevitable toll, while policymakers try to find the best way forward to encourage a more diversified economy.

Here, we explain how the Krone has been faring over the last few years, and highlight what to look for if NOK is to feature in your pairs…

Norway before the oil price crash…

When a global financial crisis hits, it has a habit of laying bare the particular weaknesses in a national economy. After the dust of 2008 had started to settle, the question asked by many was how did Norway manage to come through relatively unscathed?

In 2010, the Norwegian Prime Minister, Jens Stoltenberg explained to Newsweek how his country had managed to protect itself. Summarised, his explanation gives a useful rundown of Norway’s strengths, namely:

- A healthy, well-regulated banking sector. Pre-crash, banks represented just 2 percent of Norway’s economy and there simply wasn’t the environment where a ‘Lehman’ (or even worse, an ‘Iceland’) would be allowed to occur.

- A flexible labour market. This flexibility in supply helped keep the unemployment rate low (in 2010 it was just 3.3 percent).

- A $450bn sovereign wealth fund (currently valued at $875bn). Most of the oil revenues received by the state are invested in a combination of global stocks and bonds. The fund has two purposes: to prevent the risk of runaway growth and inflation, and to ensure that future generations have funds to rely upon once the oil has run dry.

- A willingness to apply fiscal stimulus where needed. Norway’s response to the crash involved slashing interest rates from 5.75 percent to 1.25 percent. Falling back on its oil fund, it also had the useful ability to pump up the economy with a series of public building works and infrastructure improvements.

NOK over the last two years: what happened?

From mid-2009 to early 2015, the USD/NOK rate had been mostly hovering around the 5.5-6.5 mark. That ended suddenly in late 2014. At its lowest ebb earlier this year, a dollar would buy almost 9 krone. There was even a similar trend against a reeling euro.

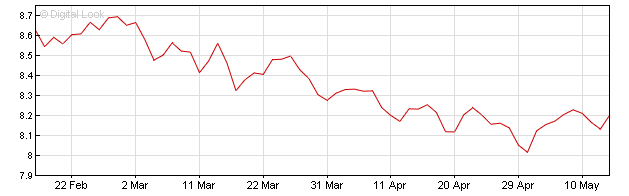

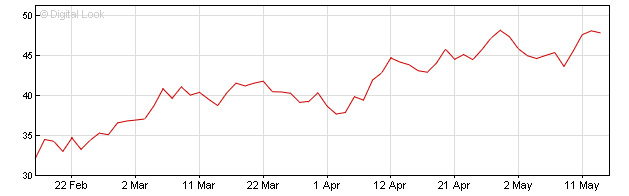

All of this corresponds with the onset of the oil price meltdown. What’s more, as the price of Brent crude has steadily gained ground over the last few months, the response has been for the krone to respond in kind, as these charts showing the USD/NOK rate and the Brent crude futures price demonstrate.

USD/NOK 3 Months to 11 May 2016 (BBC)

Brent Crude Oil Futures $/barrel 3 Months to 11 May 2016 (BBC)

Predicting the krone: is it all about oil?

Bloomberg helpfully summarised how the collapse in the global oil price to below the $50 mark has had a far more damaging effect on the Norwegian economy compared to the 2008 global crisis. Last year saw an estimated 40,000 Norwegian oil jobs disappear out of a national oil-based workforce of 250,000. The unemployment rate peaked at an all-time high of 4.8 percent in January of this year before dipping back down slightly. In 2015, the country’s economy expanded by 1.0 percent, representing the weakest growth rate since 2009.

The response has been to slash interest rates to 0.5 percent in order to combat falling private sector investments. The country has also dipped into its sovereign wealth fund in an attempt to stimulate growth. So far, these stimulus measures have helped to stave off recession, but the economy remains in the doldrums. In December, the average forecast for 2016 growth stood at 1.1 percent. By March, that had reduced to 0.8 percent.

Broadly speaking, traders should expect the global oil price to continue to have a significant bearing on the performance of the krone. However, one endemic problem faced by Norwegian businesses is that banks have been slow to reduce lending rates in response to cuts in the headline rate. Further rate cuts are considered likely over the next year or so – perhaps to 0.4 percent, 0.2 percent and even into negative territory if necessary. Expect the krone to experience downward pressure in response to any such moves – even if the Brent crude price is still on an upward trajectory.

Looking for the best platforms to trade NOK and other Forex pairs? Check out our reviews.

By Gary Smith

By Gary Smith