By Gary Smith

By Gary Smith

How to use Greeks in options trading

What exactly drives the price of each option you trade? How can you gauge the likelihood that your option of choice will expire in the money? As expiration of the option approaches, what effect is this likely to have on the option value? For any options trader, these are just some of the factors that you need to juggle to avoid costly trading mistakes.

What exactly drives the price of each option you trade? How can you gauge the likelihood that your option of choice will expire in the money? As expiration of the option approaches, what effect is this likely to have on the option value? For any options trader, these are just some of the factors that you need to juggle to avoid costly trading mistakes.

Fortunately, help is at hand in the form of what are collectively referred to as ‘the Greeks’. These are mathematical models that can help you predict how the price of an option is likely to be affected by particular events or trends. For a novice trader, getting to know your Greeks is an important part of your learning curve: it makes it less likely that you’ll act on a misplaced hunch and leads to better decisions on if – and – when to make your trade.

What are the Greeks for?

Trading is not an exact science. There will never be a mathematical model that will accurately predict the movement of an option price – or indeed the underlying asset – over any given period. But what we can do is to look at past performance. We can then use this to build a picture of what is likely or expected to happen in the future: we can say, in other words, if X occurs, the likely impact on the option price will be Y.

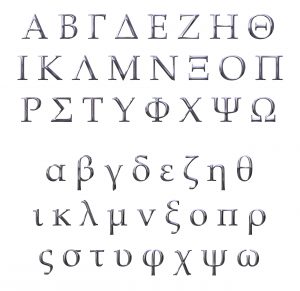

Most trading models are named after letters in the Greek alphabet (hence, ‘the Greeks’). Now we’ll look at the key ones in turn and highlight how they can be put to work by traders…

Delta: the effect of movement in the underlying asset price

Obviously, the price of the underlying asset is invariably a key influencer on the price of an option. Delta measures how far the option’s price is expected to change per-$1-change in the price of the underlying asset.

For a call, the Delta range is 0 to +1. For a put, the range is 0 to -1. As a call option moves in the money, the closer to +1 the Delta becomes. Likewise, the more in-the-money a put option becomes, the Delta moves closer to -1. At-the-money call options tend to have a Delta at or around .50, while at-the-money put options usually have a Delta at or around -.50.

Delta can also be translated into percentage terms: i.e. a Delta of 0.60 indicates that the option has a statistical chance of about 60% chance of being in the money at the time the option expires.

This greek can therefore give you a useful indication of how the option position may increase or decrease in response to changes in the underlying asset price.

Gamma: ‘Delta risk’ or ‘acceleration’

Gamma is the rate at which Delta is expected to change, based on a $1 change in the stock price. Delta is only accurate at a certain price and time; it’s constantly changing as the price of the underlying asset increases or decreases. An option’s Gamma rate is therefore a measurement of the rate of change of Delta.

Theta: the effect of time

Theta measures the impact on price of a one-day decrease in an option’s time to expiration. All options leak value as the expiration date approaches. However, this time-value erosion is not linear in nature, and the purpose of Theta is to demonstrate the impact it will have on specific options.

Theta is always expressed as a negative number and you will find that as the expiration date comes closer, the rate of value decay also increases. When you are choosing which options to trade, you will tend to find that those options with a far-out expiration data will have a slower rate of decay – but greater Delta risks.

Vega: measuring the effect of volatility

The volatility (i.e. the amount of fluctuation in price ) of the underlying asset or index is a significant influencing factor on the price of an option. Traders need to factor in the volatility characteristics of that underlying asset and to assess how that volatility is expected to change the option’s price over time. This is where Vega comes in: a measurement of the expected change in the price of an option attributed to a 1-percentage point increase in volatility.

There is no set range of values for Vega, although the position will always be positive for calls and puts, whereas short options will have a negative Vega. Volatility tends to increase in a declining market and it’s important to check the Vega for an indication of how changes in volatility levels are likely to affect the value of your option position.

For options trading, the platform you are using will typically allow you to view a row of columns showing a range of Greek values. These values can adjust markedly over time in response to market activity. Greeks can help you to decide whether a particular option lies within your risk parameters when you are making initial buying decisions. During the lifetime of your position, it’s important to monitor these readings: on matters such as price changes, volatility and time decay, they can help you pinpoint the right time to sell.

Looking for a user-friendly platform that includes all the data you need to make informed trading decisions? Check out our platform reviews to find the right one.

By Gary Smith

By Gary Smith